Turbine high performer

Tri-fecta Analysis

About

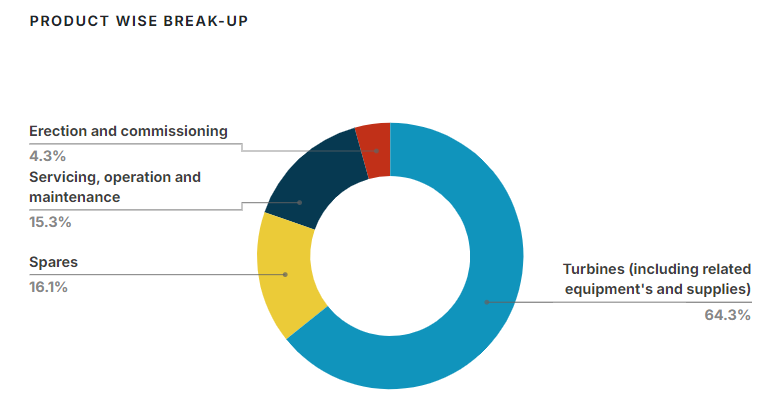

Triveni Turbine Limited (TTL) is a focused, growing and market-leading corporation having core competency in the area of industrial heat & power solutions and decentralized steam-based renewable turbines up to 100 MW size. TTL is among the leading manufacturers of industrial steam turbines globally.

Apart from manufacturing, the Company also provides a wide range of aftermarket services to its own fleet of turbines as well as turbines and other rotating equipment such as compressors, rotors, etc. of other makes supported by its team of highly experienced and qualified service engineers. The Company’s ability to provide high-tech precision engineered-to-order solutions has made it one of the most trusted names within the sector. (Source: TTL)

360 View of TTL

source: Tijori

Key Drivers

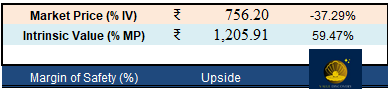

High margins on key metrics proves the operational efficiency of the Company. Additionally, the EPS PE divergence shows subdued earnings due to high reinvestment. As the business cycle turns favorable in H1FY25, the pricing power of the share shall shore up.

59.47% Upside Margin of Safety:

Key Ratio:

Revenue Margin = 31.65%

EBITDA Margin = 20.29%

PAT Margin = 16.78%

ROIC = 40.39%

ROE = 28.80%

Debt to Equity = 0.74

Retention Ratio = 98.66%

Re-investment Rate=57.53%

Future Outlook:

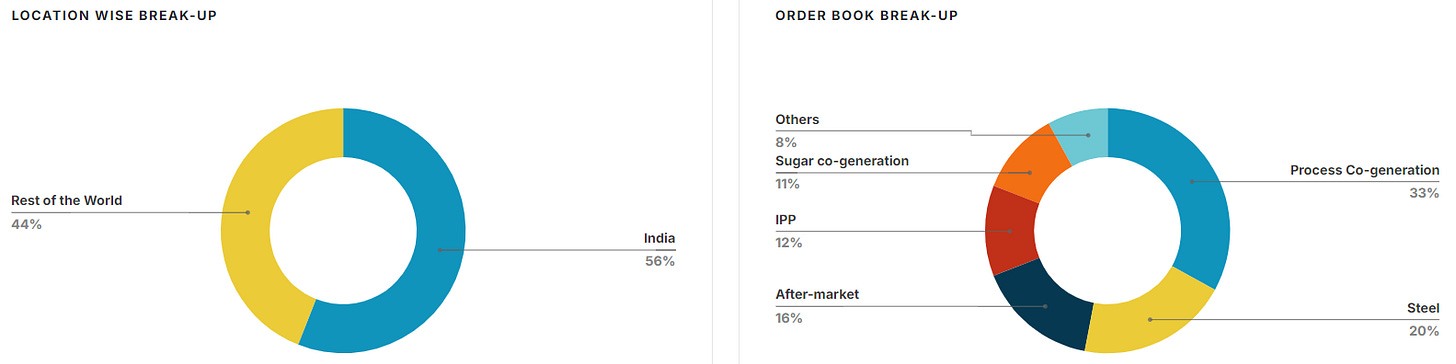

The Company’s expanding presence in global markets, along with the increasing demand for renewable energy, energy efficiency, waste-to-energy (WtE), and decentralized power solutions, continues to present substantial growth opportunities for Triveni Turbines. The Company is confident that leveraging these opportunities, both domestically and internationally, will enable it to maintain growth and profitability in the coming years. (Source: TTL)

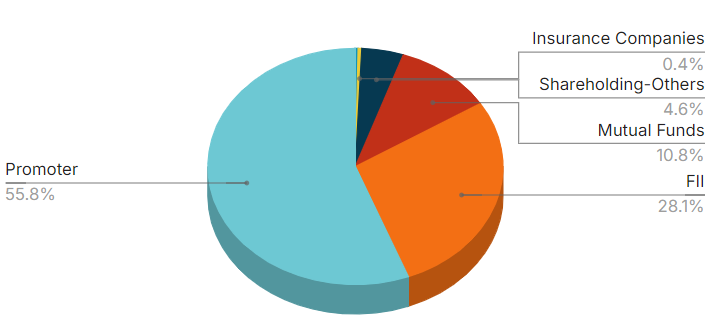

Share Holding Break-Up

Source: Tijori

Disclaimer:

The above analysis intended solely for research & analysis purpose. Shouldn’t be considered as investment advise.